數據來源

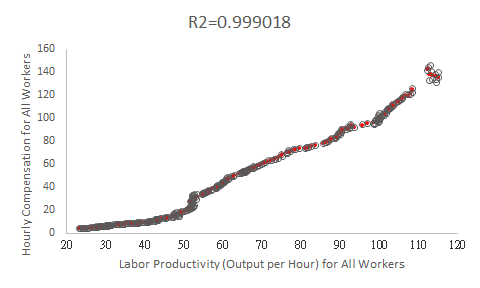

價格指標:Nonfarm Business Sector: Hourly Compensation for All Workers (COMPNFB)

數量指標:Nonfarm Business Sector: Labor Productivity (Output per Hour) for All Workers (OPHNFB)

數據說明

| 名稱 | 時薪(Y) | 勞動產出率(X) |

|---|---|---|

| 代號 | COMPNFB | OPHNFB |

| 頻率 | 季資料 | 季資料 |

| 單位 | 數字 | 數字 |

| 季節 | 有季節調整 | 有季節調整 |

| 期間 | 1947年第一季到2022年第四季 | 1947年第一季到2022年第四季 |

| 筆數 | 304 | 304 |

趨勢圖

趨勢說明

- 方法

直線多線段法。每條趨勢線保持最佳解釋,每條直線函數配適得到解釋力,直到額外增加之數字導致解釋力下降,即重新新的趨勢線。

勞動產出率對時薪的關係

- 每條趨勢線訊號

- 共34條趨勢線

line 1, 23.258000<=X<=24.919000, sorting order= 1 ~ 10, data number=10,

The estimated line Y=-4.661619+0.362887*X, R2=0.701479,

line 2, 25.377000<=X<=27.747000, sorting order= 11 ~ 19, data number=9,

The estimated line Y=-3.155610+0.293345*X, R2=0.845043,

line 3, 27.777000<=X<=28.956000, sorting order= 20 ~ 30, data number=11,

The estimated line Y=-7.850796+0.468835*X, R2=0.906840,

line 4, 29.479000<=X<=30.399000, sorting order= 31 ~ 36, data number=6,

The estimated line Y=-8.199839+0.474070*X, R2=0.401639,

line 5, 30.502000<=X<=30.940000, sorting order= 37 ~ 42, data number=6,

The estimated line Y=-51.285346+1.878931*X, R2=0.806484,

line 6, 30.954000<=X<=32.710000, sorting order= 43 ~ 49, data number=7,

The estimated line Y=-1.912080+0.277275*X, R2=0.916467,

line 7, 32.964000<=X<=33.407000, sorting order= 50 ~ 56, data number=7,

The estimated line Y=-12.145122+0.591233*X, R2=0.371633,

line 8, 33.734000<=X<=37.703000, sorting order= 57 ~ 67, data number=11,

The estimated line Y=-0.705567+0.245085*X, R2=0.974159,

line 9, 37.730000<=X<=40.778000, sorting order= 68 ~ 78, data number=11,

The estimated line Y=-2.779574+0.298096*X, R2=0.920134,

line 10, 40.928000<=X<=41.839000, sorting order= 79 ~ 84, data number=6,

The estimated line Y=-27.501779+0.901342*X, R2=0.911912,

line 11, 42.774000<=X<=43.122000, sorting order= 85 ~ 90, data number=6,

The estimated line Y=-75.624703+2.023253*X, R2=0.239249,

line 12, 43.173000<=X<=44.351000, sorting order= 91 ~ 96, data number=6,

The estimated line Y=-59.868611+1.638825*X, R2=0.815477,

line 13, 45.245000<=X<=47.027000, sorting order= 97 ~ 102, data number=6,

The estimated line Y=-9.798558+0.502709*X, R2=0.809972,

line 14, 47.289000<=X<=47.925000, sorting order= 103 ~ 108, data number=6,

The estimated line Y=-30.472965+0.967217*X, R2=0.040818,

line 15, 48.041000<=X<=51.492000, sorting order= 109 ~ 124, data number=16,

The estimated line Y=-66.662705+1.706005*X, R2=0.802138,

line 16, 51.770000<=X<=52.297000, sorting order= 125 ~ 131, data number=7,

The estimated line Y=343.587250+-6.113771*X, R2=0.213917,

line 17, 52.303000<=X<=52.435000, sorting order= 132 ~ 137, data number=6,

The estimated line Y=2443.475906+-46.125172*X, R2=0.315941,

line 18, 52.502000<=X<=53.117000, sorting order= 138 ~ 143, data number=6,

The estimated line Y=-56.576636+1.634044*X, R2=0.012659,

line 19, 53.310000<=X<=60.520000, sorting order= 144 ~ 172, data number=29,

The estimated line Y=-65.178602+1.804011*X, R2=0.968135,

line 20, 61.061000<=X<=65.433000, sorting order= 173 ~ 187, data number=15,

The estimated line Y=-41.101027+1.439681*X, R2=0.953633,

line 21, 65.454000<=X<=67.122000, sorting order= 188 ~ 197, data number=10,

The estimated line Y=-82.884764+2.069099*X, R2=0.937299,

line 22, 67.775000<=X<=74.312000, sorting order= 198 ~ 211, data number=14,

The estimated line Y=-32.663519+1.321055*X, R2=0.979244,

line 23, 75.130000<=X<=79.661000, sorting order= 212 ~ 220, data number=9,

The estimated line Y=-32.628609+1.336335*X, R2=0.765764,

line 24, 81.304000<=X<=86.513000, sorting order= 221 ~ 229, data number=9,

The estimated line Y=-1.130231+0.921706*X, R2=0.988097,

line 25, 87.173000<=X<=89.430000, sorting order= 230 ~ 236, data number=7,

The estimated line Y=-56.223003+1.566870*X, R2=0.894493,

line 26, 89.737000<=X<=90.730000, sorting order= 237 ~ 242, data number=6,

The estimated line Y=-294.305602+4.233201*X, R2=0.794051,

line 27, 91.661000<=X<=93.079000, sorting order= 243 ~ 248, data number=6,

The estimated line Y=-82.285515+1.887280*X, R2=0.534014,

line 28, 93.670000<=X<=99.036000, sorting order= 249 ~ 254, data number=6,

The estimated line Y=16.792951+0.804110*X, R2=0.681308,

line 29, 99.055000<=X<=100.026000, sorting order= 255 ~ 262, data number=8,

The estimated line Y=-339.716869+4.398153*X, R2=0.443286,

line 30, 100.036000<=X<=101.126000, sorting order= 263 ~ 269, data number=7,

The estimated line Y=-338.601085+4.374138*X, R2=0.370713,

line 31, 101.309000<=X<=103.537000, sorting order= 270 ~ 280, data number=11,

The estimated line Y=-271.535003+3.698636*X, R2=0.863639,

line 32, 103.571000<=X<=106.823000, sorting order= 281 ~ 289, data number=9,

The estimated line Y=-191.111419+2.909995*X, R2=0.982317,

line 33, 107.492000<=X<=112.785000, sorting order= 290 ~ 295, data number=6,

The estimated line Y=-381.705259+4.656591*X, R2=0.980611,

line 34, 112.978000<=X<=115.372000, sorting order= 296 ~ 304, data number=9,

The estimated line Y=272.501494+-1.188696*X, R2=0.048221,

- 整體估計結果

- 時間序 1 ~ 304

- R2 = 0.999018

- 整體資料分割成34線,

- 每條分割線樣本至少6資料個數

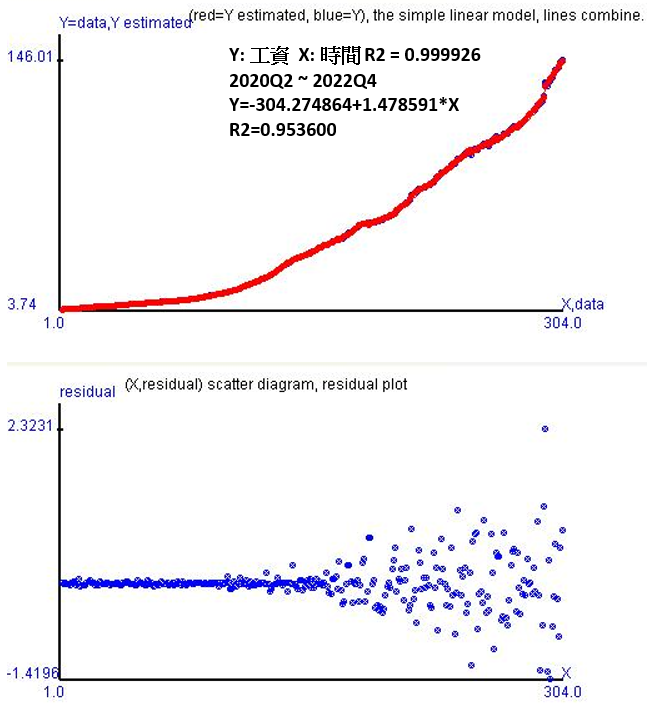

時薪趨勢

- 每條趨勢線訊號

- 共37條趨勢線

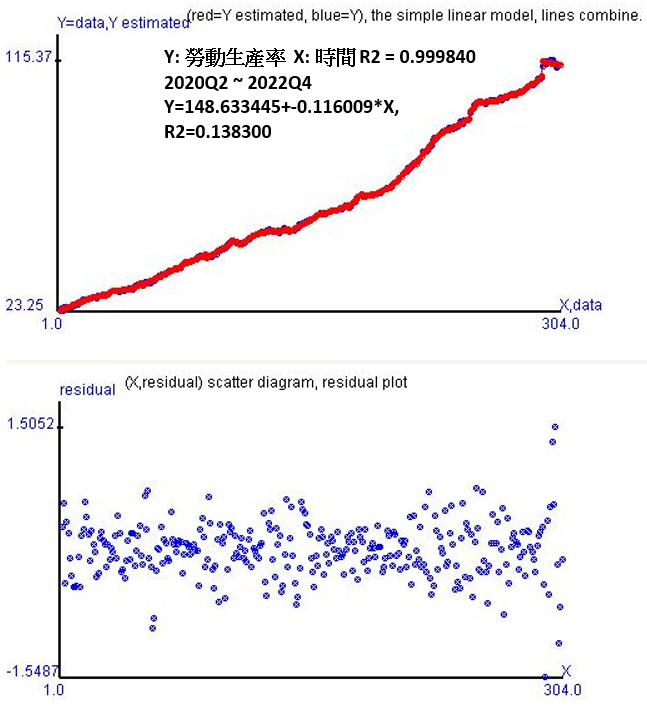

勞動產出率趨勢

- 每條趨勢線訊號

- 共34條趨勢線

詳細的方程式,請參考 連結

觀點

由於時薪和勞動產出率皆為勞動市場的指標,各自為價格和數量指標。如此一來就能對二指標尋找其關係。而美國的勞動產出率介於112.978000到115.372000的最高區間時,對應的時薪反而是下降的,並且平均每季下降-1.188696單位的時薪指數。

讓我對應勞動產出率的季度,發現都落在2020年第四季後。而美國高科技的裁員潮並非對勞動市場沒有影響,可以說美國看似失業率下降,但就業人員恐怕以普通薪資為主,導致高薪的裁員讓勞動產出率和時薪發生負斜率的趨勢情況。

從時薪的時間走勢來看,最新趨勢從2020年第二季開始,並且上升的斜率代表平均每季增加1.478591單位時薪。雖說美國因新冠肺炎的勞動運用上不如疫情前,隨著疫情緩和並不再被認為是「疫情」,而讓勞動力回到市場上。然而,同樣依賴國際貿易的美國也不免有物資的匱乏,導致物價上漲,和名目薪資需要上漲。

時薪的殘差更是呈現了愈接近現在,波動愈大。這代表美國的時薪數據隨著時間愈發不穩定。或許我們可以視為虛假的膨脹。

勞動產出率的時間走勢同樣也能得到高配適結果,最新趨勢從2020年第二季開始,但下降的斜率已然說明美國的勞動產出率並沒有因新冠疫情而復原!!!